Excitement About Lamina Reviews

Table of ContentsMore About Lamina ReviewsThe 8-Minute Rule for Lamina ReviewsHow Lamina Reviews can Save You Time, Stress, and Money.The Single Strategy To Use For Lamina ReviewsSome Known Facts About Lamina Reviews.6 Simple Techniques For Lamina ReviewsOur Lamina Reviews StatementsNot known Facts About Lamina ReviewsThings about Lamina Reviews

Whether your air conditioning unit quits working all of an unexpected or you have an unanticipated clinical expense, you can request funds online and receive an approval choice in minutes. Your expenditure is much less than $1,500. At Hill Summit Financial, you can request as much as $1,500 online to cover practically any type of cost.By asking for a personal finance on our site, you will receive an approval choice in minutes. We also use more than your credit rating score to make authorization decisions.

The Greatest Guide To Lamina Reviews

You intend to prevent a pre-payment penalty. Our customers pay no pre-payment penalties. Consumers are not punished for settling financial debt sooner as well as by doing so, conserve cash on rate of interest. We additionally promise there are no concealed costs.

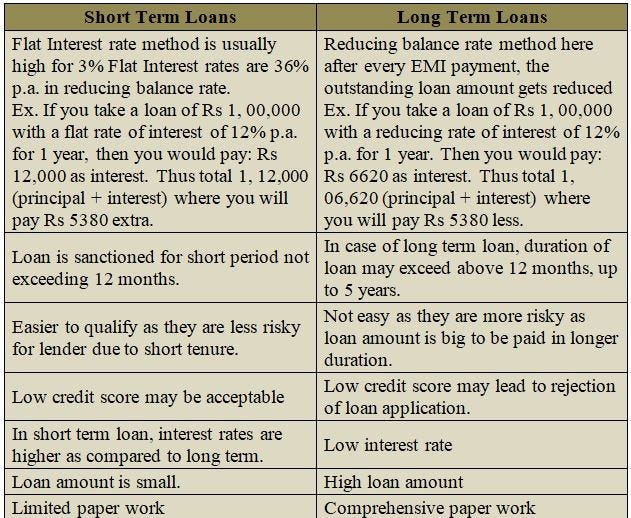

If you have less-than-perfect credit scores or do not desire a long-term commitment, conventional financing options may not work for you. That's where short-term finances come in.

Lamina Reviews Fundamentals Explained

To aid you make a decision if you need to get a temporary car loan or otherwise, below's a complete overview. Find out: What are short-term financings? Exactly how do short-term fundings function? The sorts of short term loans Passion prices on temporary car loans The benefits and drawbacks of short-term loans Where to find a short-term funding What are short-term lendings? Short-term lendings are car loans with shorter payment durations than traditional lendings, commonly twelve month or much less.

Temporary loan amounts are usually less than what conventional finances provide however differ relying on the type you obtain. Further, rates of interest and also charges tend to be higher on certain kinds of temporary lendings. How a temporary personal loan works You can get short-term car loans online or in-person at a regional bank, lending institution, or lender.

How Lamina Reviews can Save You Time, Stress, and Money.

We'll clarify a lot more about the various types of temporary car loans below. After applying, the lending institution will make a decision if it will certainly approve your lending.

Kinds of short-term personal finances Currently, allow's take an appearance at the various kinds of short-term financings you can get to cover your individual expenditures. Cash advance Payday advance are small-dollar loans, usually $500 or less, that are typically due within two to four weeks on your following cash advance, thus the name.

Lamina Reviews for Dummies

Rather, they base the financing authorization on a recent paystub. On-line payday lending institutions are still flexible however do typically inspect your credit score. The downside is, payday lendings often come with a high price. Some have APRs as high as 400%, so they're only recommended if you can't get approved for other sorts of financing.

Lamina Reviews Things To Know Before You Get This

Interest prices on temporary finances can drop anywhere in between. If you use with a lending institution that checks your credit scores, your score and background will certainly play a factor in the passion price you get.

Financial debt combination When purchasing online for a 12-month $1,000 individual lending for debt consolidation, presuming a reasonable credit report between 640 and 699, APRs vary from 6. 49% to 34. 99%. You may be able to obtain a reduced rates of interest as well as conserve cash by settling your financial obligation with a short-term car loan, especially if you have charge card debt.

Some Known Questions About Lamina Reviews.

If you require money for an emergency house renovation job, a temporary individual finance can be an excellent choice. You'll get the funds you require promptly without having to put your home up as collateral. Due to the fact that temporary lendings are typically unsecured, they may have higher rate of interest rates than secured funding options like home equity lines of credit score, which is something to maintain in mind.

Company and personal lendings usually have comparable passion rates, but personal lendings may be less complicated to receive if your firm does not have much credit report. You can additionally use temporary financings to spend for accreditations that will progress your career (Lamina Reviews). Personal car loans usually have greater rates than student finances, they use much more flexibility in the types of courses you're enabled to take, so they find out here now may be a far better option for career advancement.

The smart Trick of Lamina Reviews That Nobody is Discussing

Quick approval The majority of loan providers have online applications that only take a few minutes to complete, and you could get accepted as quickly as the following service day. Paying less rate of interest Due to the fact that there's less time for passion to build up, your complete borrowing costs might be less for a temporary funding than a lasting financing with a lower passion rate.

Getting The Lamina Reviews To Work